Condo Insurance in and around Miami

Townhome owners of Miami, State Farm has you covered.

Condo insurance that helps you check all the boxes

There’s No Place Like Home

With plenty of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm uncomplicated. As one of the top providers of condominium unitowners insurance, you can enjoy outstanding service and coverage that is competitively priced. And this is not only for your unit but also for your personal belongings inside, including things like electronics, appliances and tools.

Townhome owners of Miami, State Farm has you covered.

Condo insurance that helps you check all the boxes

Put Those Worries To Rest

When a windstorm, a hailstorm or vandalism cause unexpected damage to your condo or someone is injured in your home, having the right coverage is important. That's why State Farm offers such excellent condo unitowners insurance.

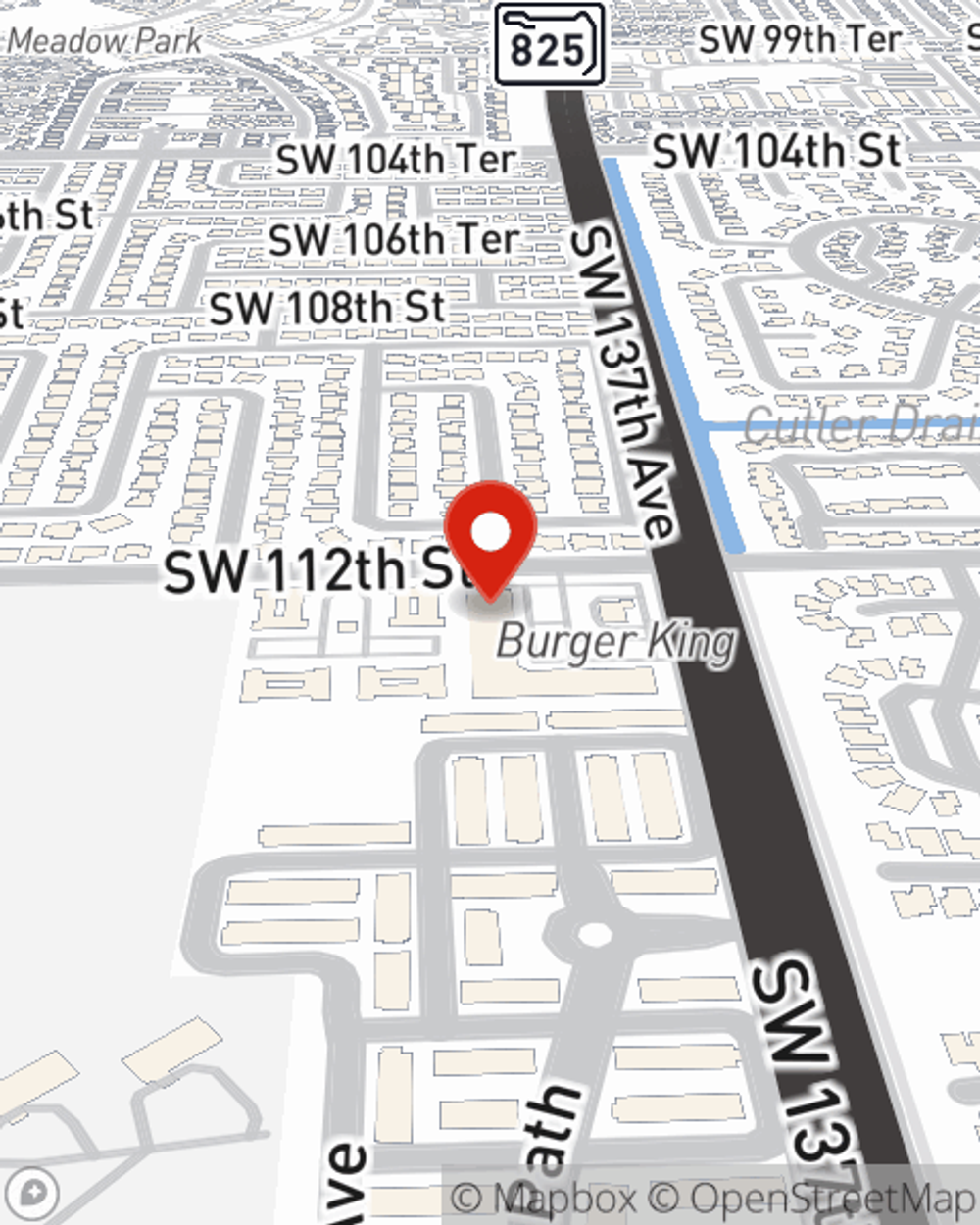

Intrigued? Agent Martina Turner can help clarify your options so you can choose the right level of coverage. Simply visit today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Martina at (305) 388-0000 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Martina Turner

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.